paying self assessment by debit card

Paying Tax due under Self. How to pay hmrc for self assessment.

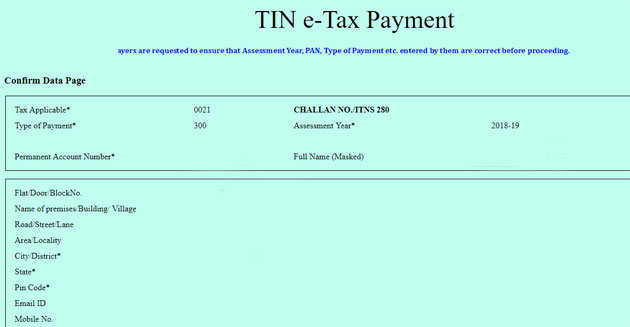

Self Assessment Tax Pay Tax Using Challan 280 Updating Itr

Send a cheque with the preprinted payslip in the preprinted.

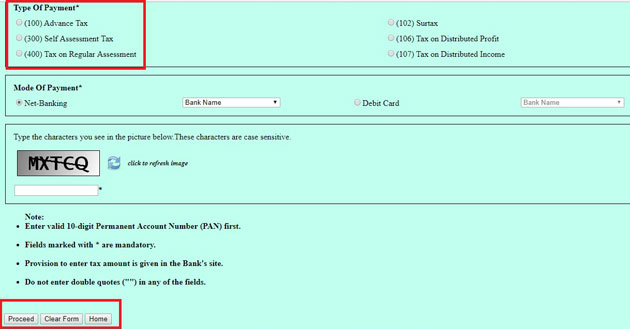

. Higher penalties have applied to tax returns from. For Tax on Regular Assessment code 400 which one has to pay if there is a demand received from the income tax. Paying Self Assessment by debit or credit card over the internet.

Corporate debit or credit card. Paying at your bank or building society. Paying HMRC Self Assessment Tax Late filing penalties are separate from late payment penalties.

You can use the new service through. In-branch at your bank or building society. On the page select 0021 Income Tax Other than companies.

Add credit card and confirm payment. There is a charge when paying by corporate credit card see Statutory Instrument 20171262 for current rates. Debit or credit card payments online.

It can be by internet banking or manually at filing challan with bank. Paying your Self Assessment bill through your tax code. Thats why our credit builder card can be a great way to improve poor credit.

Ways to pay HMRC. Pay your VAT bill. The Fees for Payment of Taxes etc.

HMRC may limit the number of times a taxpayer can use a credit or debit card within a certain time to pay their tax. How to Reprint Challan 280 SBI. By cheque through the post.

From 15 December 2014 HMRC are introducing a new online payment service for customers paying their Self Assessment or VAT bill by debit card. Employers PAYE and National Insurance. Pay your Self Assessment.

Fill up the PAN enter PAN Number Bank Account Number and the dates for transaction. Select OLTAS for income tax as Merchant name. Using Debit Card In case you used SBI Debit card to make the self-assessment tax payment you have to go to SBI Enquiry Transaction Status webpage.

Create a free Billhop account. Cheques through the post. If you have a debit or credit card issued by a UK card issuer you can pay your Self Assessment tax over the internet using the BillPay service provided by Santander Corporate Banking previously Alliance.

There are several different ways to pay your Self Assessment tax bill including. Pay your VAT bill. There isnt a set limit it depends on.

You will be redirected to a different page. Bank details for online or telephone banking CHAPS or Bacs. When paying self assessment income tax dont forget to add K to the 10 digit unique taxpayer reference UTR.

How long will it take your payment to reach HMRC. According to HMRC you can use a credit card to pay. This guide offers a reminder of the payment options available on how to pay Self Assessment Tax.

Payment options for your Self Assessment tax bill - Direct Debit bank transfer through your tax code debit or credit card cheque and pay weekly or monthly. Billhop is a payment service which enables companies and private individuals to pay bills and invoices by debit and credit card. Enter other details such as.

Credit card online only until 130118 and there is a non-refundable fee At your bank or building society with a paper statement and paying-in-slip from HMRC Bank payments made. If you have received a paying-in slip from HMRC you can also choose to walk into a bank or a building society and make the payment. By Card Regulations 2020 allows HMRC to charge business debit card users a fee based on a new formula which is equal to the.

While you cannot use a credit card to pay HMRC if it is a personal card you can use a corporate credit card for an additional fee. Pay your Self Assessment. Paying off your Self Assessment tax bill with a personal credit card sounds like a fairly simple process what with card transactions officially displacing physical currency as the UKs most popular way of paying for things.

Bank transfer using CHAPS Faster Payments or Bacs. Fill in your tax bill details. Online banking Faster payments Telephone banking Faster payments CHAPS.

Also for Self Assessment Tax which is paid before filing ITR the code is 300. Customers can continue to pay HMRC by debit and credit card using the Billpay service hosted by Santander Corporate Banking. Payment options for your Self Assessment tax bill - Direct Debit bank transfer through your tax code debit or credit card cheque and pay weekly or monthly.

Alternatively you can also choose to pay via BACS Direct Debit or by. You can choose to pay your Self Assessment tax bill online or by telephone banking by debit or corporate card online not personal credit card or CHAPS. We help set additional cookies to understand how to use govuk remember your settings and improve government services.

All major cards including American Express are accepted and you can make payments to any British sort code and. Self Assessment payment of personal tax the traditional way. Unfortunately back in January 2018 HMRC announced they were no longer supporting payments from a personal debit card because of.

How to pay HMRC with Billhop. This is a trial known as a beta service and HMRC is working in partnership with Worldpay. The whole mission of Self Financial is to help people build credit and save money.

Checking your payment has been received. On that page under the last option Non-TDSTCS select Challan No. 21 October 2013 no dear.

Ganeshbabu K Expert Follow. Paying your self assessment bill For same or next day payments use. From 1 November any payments to HMRC such as the self-assessment tax return bill income tax from a previous underpayment or stamp duty will incur a fee where people use a business debit card.

This secured credit card was designed for people whose credit is bad or poor as defined by FICO and is meant to be another tool for you to use to work on improving your credit. Paying hmrc self assessment by debit card How to pay hmrc self assessment online. The new service will.

21 October 2013 yes you cannot pay through debit card. Only possible via net banking facility. Setting up a Direct Debit.

How do i pay hmrc self assessment. We use some essential cookies to make this website.

Income Tax Payment How To Pay Taxes Online And Offline

Income Tax Payment How To Pay Taxes Online And Offline

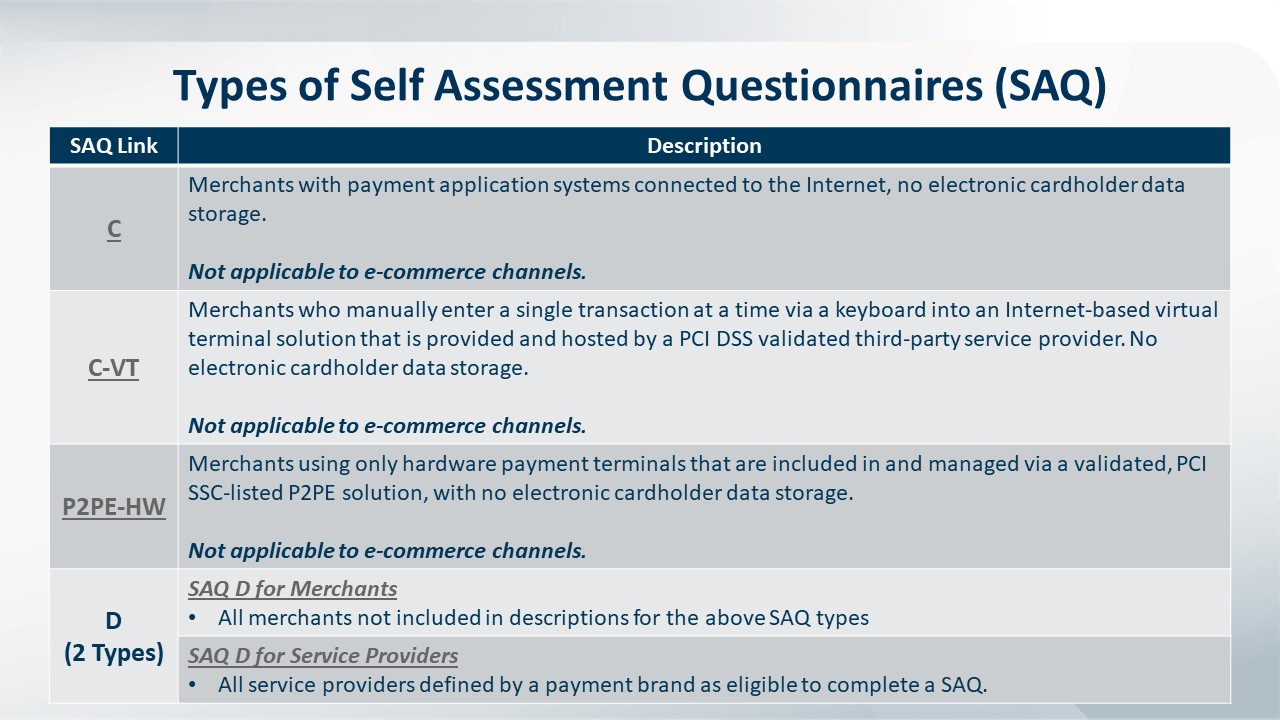

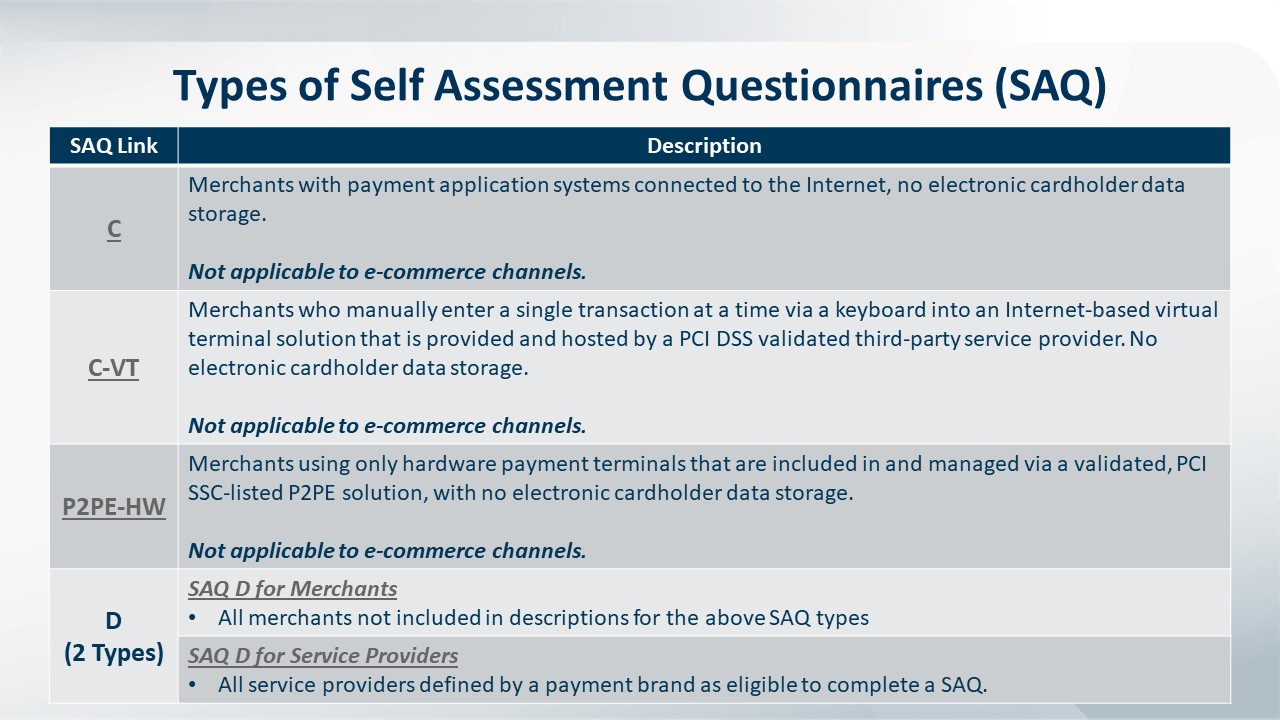

Pci Dss Saq Just Like That Self Assessment Is Possible

How To Do A Pci Self Assessment Infosec Insights

How To Pay Self Assessment Tax Online By Internet Banking Or Debit Card Youtube

Income Tax Payment How To Pay Taxes Online And Offline

Credit Vs Debit Which Is Better Ramseysolutions Com

How To Prepare A Self Assessment Questionnaire Pci Saq Cybersecurity And Training

0 Response to "paying self assessment by debit card"

Post a Comment